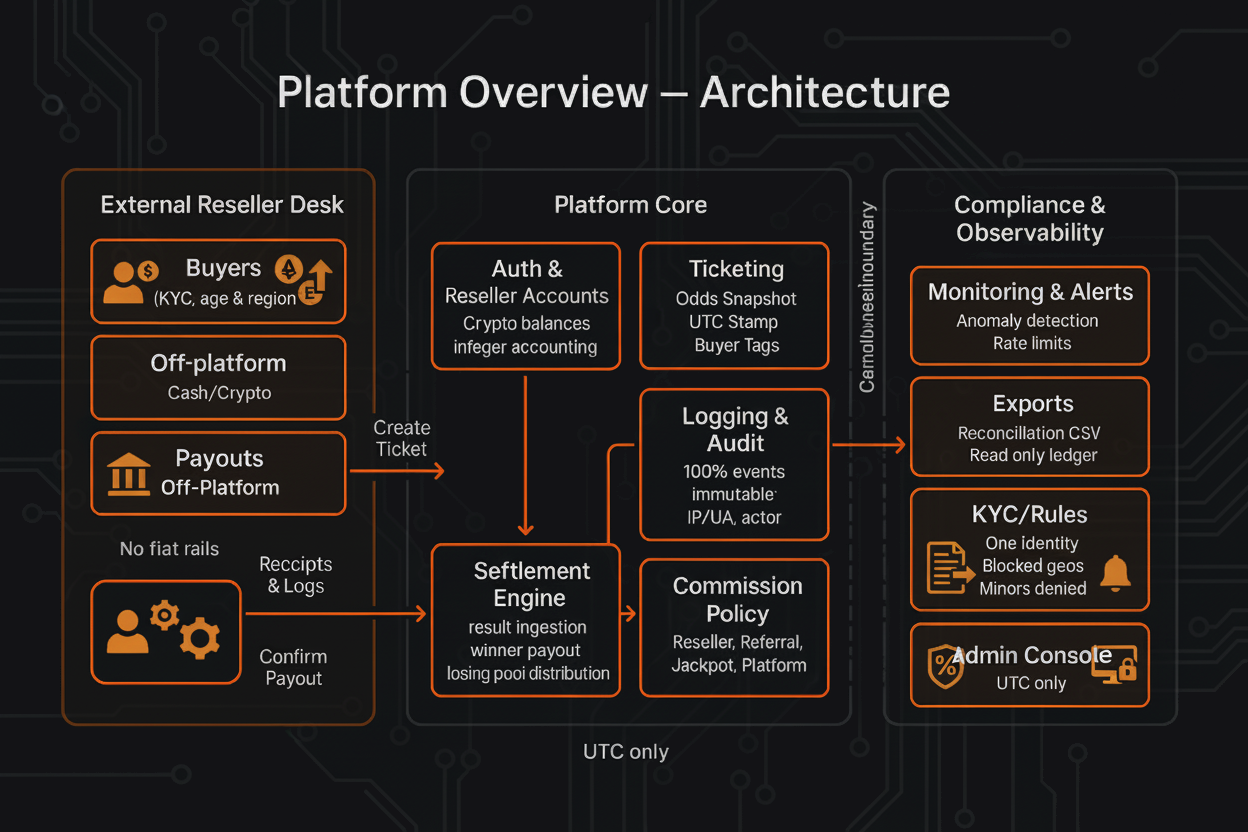

Platform Overview

The platform is architected for crypto-only accounting and settlement. Balances are kept in stablecoins (e.g., USDT/USDC), and every unit of value is tracked as atomic integers to eliminate rounding drift and ensure deterministic reconciliation.

Resellers operate external desks: they onboard and verify buyers off-platform, collect funds outside the system, and then place tickets using their own platform balance. The platform never handles buyer fiat; it only accounts for the reseller’s crypto balance.

Every action is audit-first. Ticket creation, odds snapshots, updates, freezes, and settlement events are immutably logged with UTC timestamps, actors, request metadata, and monotonic sequence identifiers. This enables end-to-end traceability and dispute resolution.

Odds are pool-based and dynamic. Incoming liquidity moves prices until the game freezes; each ticket locks its own odds snapshot at creation. After the official result, the losing pool pays the winners and policy rules distribute commissions.

Compliance guards the lifecycle. Only one legal identity per reseller is allowed. Minors and restricted jurisdictions are prohibited. Repeated fraud signals trigger automatic locks, fund freezes pending review, and permanent bans when violations are confirmed.

Security follows least privilege and fail-closed defaults. Inputs are whitelisted, credential flows are rate limited, and all sensitive operations are idempotent. Monitoring hooks provide anomaly detection and tamper-evident logging.

The system is modular by design: new sports, markets and dashboards can be added without changing the accounting core. Internationalization is supported at the presentation layer while preserving UTC, integer math and immutable receipts at the core.

Roadmap (high level): richer market types, automated KYC integrations for resellers, programmable commission policies per sport/league, advanced reconciliation exports, and read-only public ledgers for post-event settlement proofs.

What the Platform Does

Tracks reseller crypto balances, issues tickets with odds snapshots, freezes markets on schedule, settles results, credits payouts, and computes commissions under policy.

What the Platform Does Not Do

It does not receive or disburse buyer cash, does not mediate off-platform disputes, and does not accept fiat rails. External collections and payouts remain the reseller’s responsibility.

Why It’s Built This Way

Separation of concerns reduces regulatory surface, simplifies audits, and makes reconciliation fast, deterministic and defensible.

- Step 1

Fund Balance

Reseller tops up their crypto balance (stablecoins). No buyer funds enter the platform.

- Step 2

Create Ticket

During the open window, reseller creates a ticket; odds snapshot is locked at creation and fully logged.

- Step 3

Freeze

Market freezes before the event starts; pools stop moving and await the official result.

- Step 4

Settle

Admin records the official result; winners are credited, losers debited, and policy splits are computed.

- Step 5

Commissions

Reseller commissions unlock after external payout confirmations to buyers are recorded.

| Area | Platform | Reseller |

|---|---|---|

| Funding | Tracks only the reseller's crypto balance (stablecoins). | Collects buyer funds off-platform; keeps local records. |

| Bet Placement | Executes tickets under reseller account; locks odds snapshots. | Creates tickets for buyers and tags them (nick/doc) for audit. |

| Payouts | Credits reseller balance upon winning settlement. | Pays external buyers off-platform and confirms payout. |

| Disputes | Provides immutable receipts and logs. | Handles buyer-facing disputes and documentation. |

| Compliance | One identity per reseller, logs, freezes and bans. | Verifies age/jurisdiction of buyers; follows rules and policies. |

- Crypto-only: no fiat rails, no third-party custody.

- One legal identity per reseller; multi-accounting is banned.

- Immutable audit logs with UTC timestamps and actor metadata.

- Idempotent, whitelist-driven API surfaces for critical operations.

- Commission unlock depends on external payout confirmations.

Resellers Program

The Resellers Program enables vetted operators to run an external desk: onboard and verify buyers off-platform, collect funds outside the system, place tickets from their own platform balance, and handle external payouts. The platform itself is crypto-only and does not touch buyer cash; it focuses on accurate accounting, immutable receipts, and deterministic settlement.

Every ticket is linked to a real reseller identity. Tickets capture an odds snapshot at creation and are fully auditable. After the official result, the losing pool funds winners and the policy split computes commissions. Resellers unlock commissions only after confirming that all external buyer payouts have been completed.

This separation of concerns reduces regulatory surface and creates a clean audit trail: off-platform collections and payouts remain the reseller’s responsibility, while the platform guarantees integrity for balance movements, odds snapshots, settlement math, and event logs.

What You Do

Verify buyers (age/jurisdiction), collect funds off-platform, create tickets from your balance, tag buyers for audit, pay winners externally, and confirm payouts.

What We Do

Enforce rules and locks, keep balances in stablecoins, snapshot and freeze odds, settle results, calculate commissions, and provide immutable receipts.

Why It Works

Clear separation: you own the off-platform money flow; the platform owns deterministic accounting and audit. Less friction, faster reconciliation, fewer disputes.

- Step 1

Apply

Submit the application with a valid referral rescode and complete identity details.

- Step 2

Pre-Screen

Initial checks on identity, region eligibility, and referral validity.

- Step 3

KYC & Docs

Provide official documents. One legal identity per reseller is enforced.

- Step 4

Training

Learn ticket creation, buyer tagging, reconciliation, and payout confirmations.

- Step 5

Go-Live

Fund your crypto balance, open eligible markets, and start issuing tickets.

- Legal age in your country and permitted jurisdiction for online betting.

- One legal identity per reseller; multi-accounting or shared identities are prohibited.

- Ability to collect and disburse funds off-platform in compliance with local laws.

- Willingness to follow platform policy updates and pass periodic compliance reviews.

- One Identity Policy

- Each natural/legal person can hold a single reseller account; attempts to multiply identities lead to bans.

- Restricted Jurisdictions

- Locations where participation would violate law or platform policy.

Prohibited Practices

Accepting minors or restricted jurisdictions; fabricating KYC; multi-accounting; re-selling tickets; hiding external payout failures; or any attempt to tamper with logs.

Best Practices

Keep buyer KYC snapshots, timestamp receipts, reconcile daily, confirm payouts promptly, and escalate anomalies early.

- Rescode

- Referral code that links your application to a sponsoring reseller/leader for hierarchy and oversight.

- Buyer Tag

- Nick/document fields attached to each ticket to enable traceability and audits.

- Payout Confirmation

- Your on-platform acknowledgement that winners were paid off-platform, required to unlock commissions.

- Holdback

- Temporary retention of commissions pending dispute resolution or compliance review.

Does the platform accept fiat from my buyers?

No. Buyers pay you off-platform. Only your crypto balance on the platform is used for tickets and settlements.

Can I have multiple reseller accounts?

No. One legal identity per reseller. Attempts to duplicate identities result in permanent bans.

When do I receive my commissions?

After settlement, once you confirm external payouts to winners and no holds are active.

What if a buyer disputes a result?

You handle buyer-facing disputes. The platform provides immutable receipts and logs for fact-checking.

How Betting Works

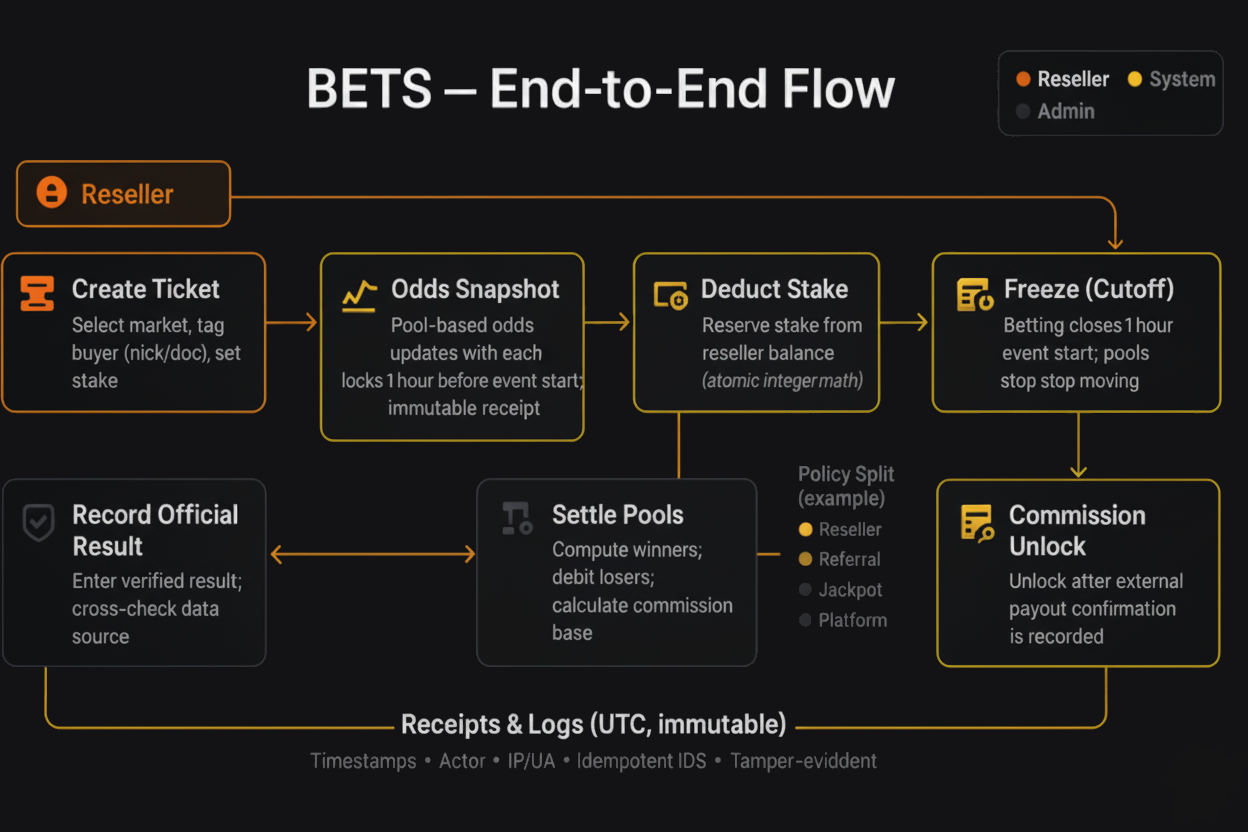

Resellers place bets on behalf of external buyers using the reseller’s crypto balance. Each ticket locks an odds snapshot at the moment of creation and carries a complete, immutable receipt for audit. Markets accept tickets during the open window and automatically freeze before the event starts. After the official result, settlement credits winners and debits losers; commissions are computed by policy and unlock after external payouts are confirmed by the reseller.

The platform focuses on deterministic accounting and auditability: all operations are UTC-stamped, actor-scoped, and idempotent where applicable. Off-platform cash collection and buyer payouts are owned by the reseller; the platform does not touch buyer fiat.

- Step 1

Open & Select

Choose an open market and selection within the policy window.

- Step 2

Enter Stake

Provide stake amount; system validates balance and limits before creation.

- Step 3

Tag Buyer

Attach buyer nick/doc for traceability and downstream reconciliation.

- Step 4

Issue Ticket

Ticket is created; odds snapshot is locked; receipt is persisted.

- Step 5

Freeze

Market freezes pre-start; pools stop moving and await the official result.

- Step 6

Settle

Admin records the official result; payouts and commissions are computed.

- Step 7

Confirm Payouts

Reseller pays external winners off-platform and confirms to unlock commissions.

Ticket creation is allowed only while the market is open and the reseller has sufficient verified balance. The created ticket locks its own odds snapshot and contributes to live pools until the market freezes.

Buyer identity is not stored as full PII; instead, buyer tags (nick/doc) are attached for audit, enabling traceability without exposing unnecessary personal data.

- Open window enforcement (no backdating or post-freeze creation).

- Balance check and min/max stake validation before issue.

- Odds snapshot captured atomically at creation time.

- Buyer tag required (nick/doc); one reseller identity per account.

| Field | Description | Example |

|---|---|---|

| marketId | Unique market identifier | SOCCER:ENG:PL:2025-01-12:MUN-LIV:1X2 |

| selection | Chosen outcome | Home Win |

| stake | Amount debited from reseller balance (atomic units) | 100000 (== 1.00000) |

| oddsSnapshot | Odds locked at creation | 2.18 |

| buyerTag | Buyer nick/doc for audit | john_doe • DOC:BR1234 |

| issuedAtUtc | UTC timestamp when ticket was created | 2025-01-06T13:22:31Z |

| ticketHash | Integrity hash of the receipt payload | sha256:... |

| Status | When It Occurs | Notes |

|---|---|---|

| Issued | Ticket successfully created during open window | Odds snapshot locked; receipt stored |

| Frozen | Market passes freeze threshold | No new tickets; pools stop moving |

| Settled — Won | Official result credits payout to the reseller balance | Included in settlement receipt |

| Settled — Lost | Stake consumed by losing side | Included in settlement receipt |

| Voided | Event/market cancelled under policy | Stake returned; reason logged |

- Always tag buyers consistently (nick/doc) to simplify reconciliation.

- Validate stake and exposure before issuing tickets to avoid rejects.

- Export daily receipts and compare against your external ledger.

- Confirm external payouts promptly to unlock commissions.

- Odds Snapshot

- The odds value captured at ticket creation; used for payout calculation regardless of later pool movements.

- Freeze Window

- Time interval before start when market stops accepting tickets and pools lock.

- Buyer Tag

- Non-PII fields (nick/doc) attached to tickets for traceability and audits.

- Void

- Ticket cancellation due to market/event cancellation under policy; stake is returned.

Can a ticket be edited after creation?

No. Edits are not allowed. Voids occur only if the market is cancelled under policy.

Which balance funds the ticket?

Only the reseller’s on-platform crypto balance. Buyer cash never enters the platform.

When are winners paid?

At settlement, after the official result is recorded. Commissions unlock once external payouts are confirmed.

Do odds change after I issue a ticket?

No. Your ticket keeps the snapshot captured at creation, even if pools move later.

Dynamic Odds

Odds are pool-derived and exist at the market level, not per ticket. While the market is open, incoming liquidity continuously updates the market odds.

At the policy cutoff (e.g., 60 minutes before start), the market FREEZES and a single, immutable market-level odds snapshot is stored. All tickets placed earlier will be settled using this final freeze snapshot.

There is no per-ticket odds lock at creation time. Tickets record selection and stake; the payout multiplier is the market's final odds at freeze. All math uses deterministic, integer-based accounting (atomic units) with tamper-evident receipts.

Market-Level Snapshot

A single odds snapshot is captured at freeze and used for all tickets in that market.

Liquidity-Driven

Odds respond to pool size and imbalance while open; heavy inflows compress the favored side.

Deterministic Math

Integer-only accounting removes drift; reconciliation is exact and audit-friendly.

The engine prices outcomes from the relative weights of their liquidity pools. Odds update with every accepted stake until the freeze cutoff.

Receipts carry: market ID, outcome, stake, UTC timestamp, actor, and monotonic sequence IDs. The payout multiple used for settlement is the market's freeze snapshot—shared by all tickets in that market.

| Factor | Impact on Odds |

|---|---|

| Pool Size ↑ (one side) | Odds ↓ for that side (compression) |

| Pool Size ↓ (one side) | Odds ↑ for that side (risk premium) |

| Imbalance ↑ | Heavier side compresses more; the other side pays richer multiples |

| Late Liquidity (pre-freeze) | Moves the curve until the cutoff is hit |

| Smoothing/Guardrails | Clamp extreme jumps; keep quotes tradable and auditable |

- Step 1

Open

Market accepts tickets; odds evolve with liquidity.

- Step 2

Freeze

At policy cutoff (e.g., −60m), capture the single market odds snapshot.

- Step 3

Event & Result

Admin records the official result for the market.

- Step 4

Settlement

All tickets settle using the market's freeze snapshot; winners paid, losers debited, commissions computed.

Game Lifecycle & Settlement

1) Open & Accepting

Games open within policy window. Tickets are issued instantly.

2) Freeze & Await Result

Betting freezes; pools lock pending official result.

3) Close & Settle

Admin closes with official result; payouts & commissions are computed.

Compliance & Eligibility

- No minors; verify age and local legality.

- No restricted jurisdictions.

- One legal identity per reseller; fraud => ban/freeze.

- Resellers are fully responsible for off-platform cash flows.

- Rules can change; staying updated is mandatory.

- Restricted Jurisdiction

- Region where betting is not permitted by law.

- Audit Freeze

- Funds held until compliance review is complete.

Security & Audit

Controls

Lockouts on repeated failures; 100% action logging; strict input whitelists; idempotent ops.

Accounting

Integer math (atomic units); per-event invoices/receipts; separation of crypto vs. off-platform cash; role-aware dashboards.

Glossary

- Reseller

- Operator who manages external clients off-platform and places bets.

- Dynamic Odds

- Pool-derived odds that adjust with liquidity.

- Settlement

- Official closure process computing payouts and commissions.

- Audit Trail

- Immutable logs of actions, timestamps, and actors.

FAQ

Does the platform accept fiat?

No; balances are crypto-only (USDT/USDC).

Can clients place bets directly?

External clients do not interact directly; resellers place bets on their behalf.

When are commissions unlocked?

After closure and reseller confirmation that external winners were paid.

Disclaimer: This page summarizes how the system works today and current policy parameters. It is not legal advice. Availability and rules may vary by jurisdiction. The platform may update terms, percentages, or constraints at any time to satisfy compliance and security.